Nurphoto

- Bitcoin could surge 34% from current levels as technicals signal a risk-on environment for the cryptocurrency market, according to Fairlead Strategies' Katie Stockton.

- Stockton expects bitcoin to consolidate its recent gains for the next one to two weeks before moving higher.

- "Bitcoin is likely to clear $42,600 for a revised upside target of a secondary fibonacci retracement level near $51,000," Stockton said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Bitcoin could be on the verge of further upside as technicals signal a risk-on environment for the cryptocurrency market, Fairlead Strategies' Katie Stockton said in a note on Monday.

Stockton sees bitcoin ultimately jumping to $51,000, representing potential upside of 34% from current levels, following a consolidation of its recent gains. Bitcoin jumped more than 40% since its July low of about $30,000 before it topped out at resistance near $42,600.

"We expect the pullback to mature in 1-2 weeks near the 50-day moving average (~$34,800), after which bitcoin is likely to clear $42,600 for a revised upside target of a secondary fibonacci retracement level near $51,000," Stockton said.

In technical analysis, traders use the fibonacci retracement tool to help identify levels of support and resistance that a security might encounter during a sell-off or rally. The tool is applied to a high and low in a security's price and then based on the Fibonacci "golden ratio," which focuses on the 61.8%, 50%, 38.2%, and 23.6% levels.

Stockton observed that long-term momentum remains positive for bitcoin, and a loss in medium-term downside momentum sets bitcoin up well for further upside.

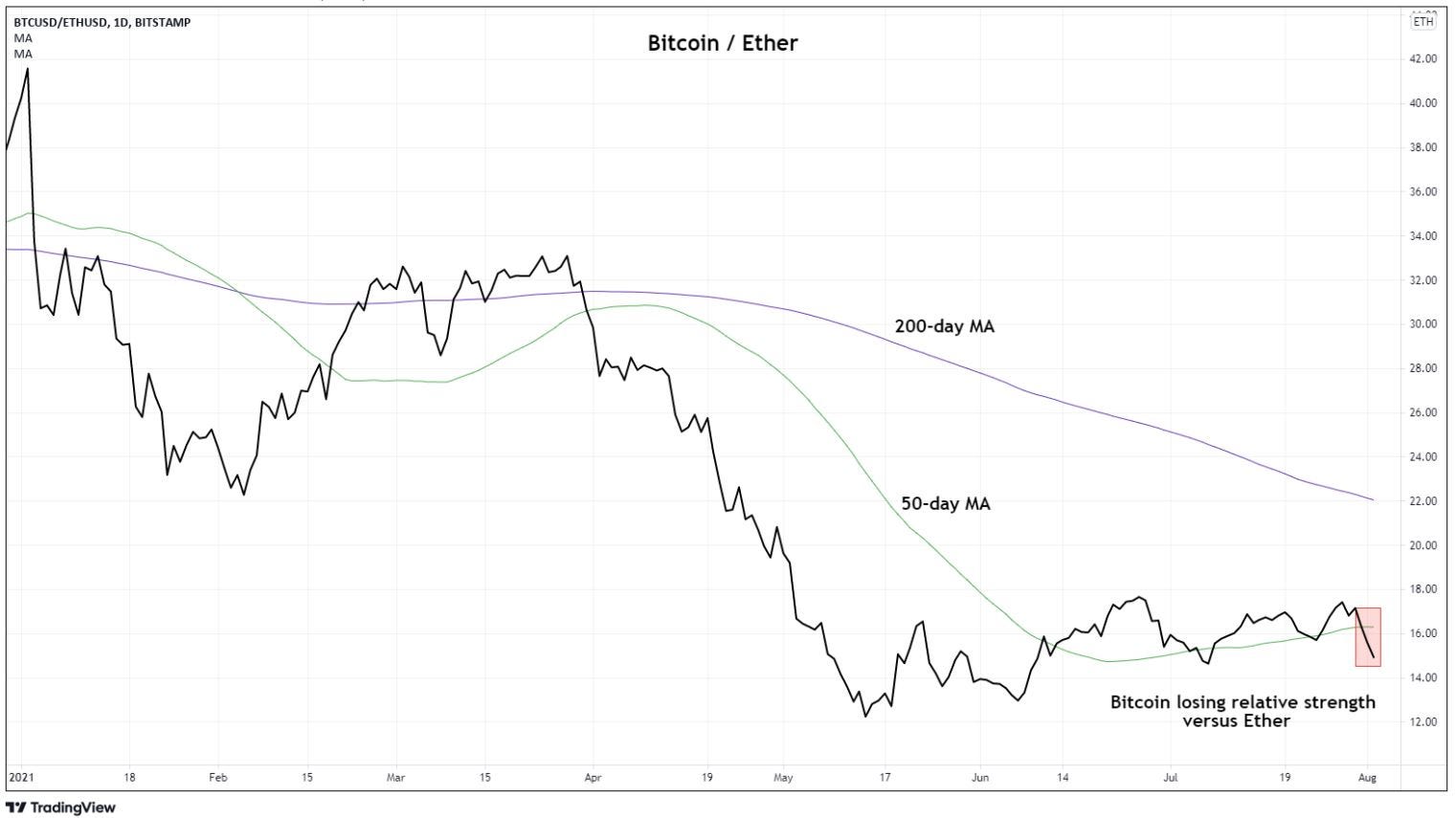

Additionally, bitcoin's loss of relative strength versus ether signals "a potential switch to risk-on environment within the cryptocurrency space," Stockton said. Ether has soared as much as 57% since its mid-July low.

If bitcoin does find support near its 50-day moving average, it would represent a 9% decline from its current level of about $38,200.